San Tan Valley is writing its first-ever town charter — our constitution for how we govern ourselves. And if we’re serious about protecting our future, there’s one rule that must be carved in stone from day one:

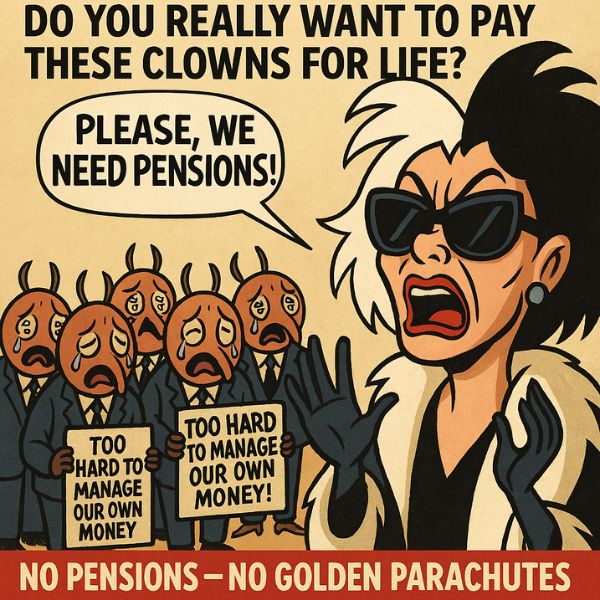

No Pensions for Politicians or Town Staff.

Why? Because Pensions Are a Developer’s Best Friend

Lobbyists and big developers love pensions — not because they care about public employees, but because pensions are bargaining chips.

Here’s how the game works in other Arizona towns:

-

Promise a city manager or department head a fat pension after a short time in office.

-

Get them to play ball with big development deals, fast-track zoning changes, or look the other way on shady contracts.

-

Taxpayers get stuck paying for that “thank you” for 20–30 years after the person is gone.

It’s a slow-motion transfer of your hard-earned money into the pockets of insiders — long after they’ve left office.

Why Defined Contribution Plans (Like a 401a or 457b) Are Better

Instead of a lifetime taxpayer-funded pension, a defined contribution plan works like a private-sector 401k:

-

The employee owns it — it’s their account, not the town’s debt.

-

The town can match contributions up to a reasonable limit (say 5–10%).

-

No unfunded liabilities — once the contribution is made, the town’s obligation is done.

-

If an official leaves, they take their account with them. No “forever bill” for the taxpayers.

This Protects Our Financial Future

San Tan Valley has big challenges ahead — infrastructure, water security, public safety. The last thing we need is decades of pension debt dragging us down. Cities that got hooked on pensions are now cutting services and raising taxes just to cover retirement checks.

Our charter can lock in a “no pensions” rule, so future councils can’t quietly bring them back without a public vote.

This Tests Our Leaders’ Brains

We’re supposed to be electing the best and brightest to run our town — people with real-world skills, financial smarts, and the ability to manage a budget.

If they can’t handle their own retirement account without the taxpayers guaranteeing it for life, maybe they’re not the right person for the job.

The Charter Clause We Need

Section X: Retirement Benefits

The Town of San Tan Valley shall not establish, participate in, or contribute to any defined-benefit pension plan for elected officials, appointed officials, or employees. The Town may offer a defined-contribution retirement plan, such as a 401(a), 401(k), or 457(b), with employer contributions not to exceed a percentage established by ordinance. This provision may be amended only by a majority vote of qualified electors of the Town.

Bottom Line

No pensions = no golden parachutes.

It protects taxpayers, removes a tool for political favoritism, and keeps San Tan Valley financially stable for decades. If our future leaders are as smart and capable as they claim, they’ll have no problem building their own retirement the way the rest of us do — by earning it and managing it themselves.

Real World Examples:

Here are some real-world examples from across the U.S. where pension systems and public officials were caught in abuses—ranging from spiking benefits to fraudulent enrichment—to highlight why strict “no pension” language in San Tan Valley’s charter matters:

Connecticut: Overtime Pension-Spiking Abuse

A study revealed systematic abuse of overtime payments to inflate retirement benefits—most egregiously, a corrections officer who increased overtime to 176% of his salary in his final months, resulting in a significantly larger pension. Legislative proposals now aim to remove overtime from pension calculations. Carolina Journal+7Reason Foundation+7CalMatters+7CT Insider+1

Broadmoor, CA: Unlawful Pension Spiking by Police Chiefs

An audit from CalPERS found that three police chiefs and a retired commander in this small town manipulated their employment status to receive inappropriate pension payouts—spiking benefits via loopholes in the system. Reason Foundation

North Carolina: $8 Million in College Pension Spiking

Public colleges in North Carolina racked up nearly $8 million in added pension liability due to spiking practices—primarily through end-of-career compensation increases without actual state reform to stop them. Empire Center for Public Policy+8Martin Center+8Wikipedia+8

City of Bell, CA: Salary & Pension Corruption

City officials in Bell climbed to astronomical salaries—one city manager’s pension was estimated at $880,000/year—through charter exemptions and abused compensation structures, sparking criminal investigations and pension system crises. Wikipedia

Massachusetts: Pension Forfeiture for Corrupt Speaker

Former MA House Speaker Sal DiMasi was convicted of corruption and had his $60,000/year pension revoked by the state retirement board, setting a rare precedent that criminal public misconduct should strip benefits. Wikipedia

Why It Matters

These cases demonstrate a pattern: without strict limitations, pensions become tools for insider enrichment, not public service. Taxpayers get stuck paying exorbitant lifelong payouts due to loopholes, OD, or loyalty-driven compensation quirks.

Implications for San Tan Valley's Charter

By banning defined-benefit pensions in your charter and locking in defined-contribution plans only, you eliminate the chance of abuse from day one. That means:

-

No sudden jumps in pensions via overtime or bonuses

-

No double-dipping public salaries or disability schemes

-

No long-term taxpayer debt from short-term political favors

Let’s write the charter so residents are never left paying for someone’s padded retirement.